Cluster chart (footprint) and order matching system at exchange

Cluster chart (footprint) and order matching system at exchange

Cluster chart, or rather one of its varieties (footprint) provides a great service to traders in the identification of the right point for opening a position. The given chart type was created by US company “Market Delta” that specializes in providing traders with professional trading software.

A footprint is nothing more than specifically structured information regarding filled market orders at the price levels in the market. Due to this chart, we can identify the volume of filled contracts within the candle on the chart. It also should be noted that information concerning the executed contracts at the price levels dissents separately on buyers and sellers’ market orders.

With this chart, we can get the following information:

1) Number of sell market orders filled on a certain price level

2) Number of buy market orders filled on a certain price level

3) POC of a price bar

It should also be noted that in addition to the fact that the footprint allows us to see the number of market orders traded at certain prices, we can also find out how many Buy limit and Sell limit orders were executed at each price level.

To understand what advantage a trader would have if he uses cluster chart in trading, we need to fathom what orders are operated at exchange, what are the characteristics of that orders and how they matched. It is crucial to know this information in order to trade profitably. It should be noted that those rules are universal and could be applied to any exchange: forex, stock market or mercantile exchange.

There are two types of orders that are utilized at exchange: limit orders and market orders.

Limit order – this is a passive order that is usually reflected at one of the module of the trading terminal – Depth of market (DOM). All those limit orders that are received by exchange in a real-time mode are indicated in the module. On the lower left part of DOM we could see buy limit orders and on the upper right part of DOM, we can see sell limit orders.

Pic. 1 Disposition of limit orders in DOM

A limit order is a passive order, to activate it, we need to match it with market order. It could be said that limit order guarantees that trader will be able to buy and sell the product at the exact price, but there is no guarantee that his order will be ever filled.

Market order – it is an active order by nature and when it is filled, the trader has 100% guarantee that he will be able to open a position, but it is not guaranteed that the order would be executed at the price that trader desired.

Based on all the above mentioned, we could say that there are certain rules regarding the order matching at exchange:

1) Buy limit orders are matched only with sell market orders. The number of buy limit orders filled at a particular price level should be equal to the number of sell market orders executed at that exact price level. In that particular case, the initiator of the deal is a seller, as he fills his order by market price (meaning that he agrees on the nearest buyer’s price that is available at that moment in the DOM). So, in this instance, it is considered that the seller is an aggressor because he initiates the deal.

2) Sell limit orders are matched only with buy market orders. The number of sell limit orders filled at a particular price level should be equal to the number of buy market orders executed at that particular price level. In this particular case, the initiator of the deal is a buyer, as he fills his order by market price (meaning that he agrees on the nearest seller’s price that is available at that moment in the DOM). So, in this instance, it is considered that buyer is an aggressor, because he initiates the deal.

Pic.2 Orders matching rule at the exchange

3) In case of filling market orders, exchange sets the following priorities: time and the size of the orders, meaning that:

· The market order, which is sent first would be filled the first;

· From the several orders that were sent to the exchange in the same period of time, the first execution would get the order that has the bigger size.

4) In case of filling market orders, exchange sets the following priorities: price, time and the size of the order, meaning that:

· The first execution would get the order that offers the best price to the buyer/seller;

· From the several orders that were sent to the exchange, the order that was sent to the exchange the first will be filled the first.

· From two orders that were sent to the exchange that has the same execution price, the first would be filled the order that has the bigger size.

5) Limit orders (Sell limit, buy limit) has the power to stop the price at a particular level, but they can’t move the price up or down.

6) Only market orders have an ability to move price upwards or downwards (buy market, sell market).

In order to comprehend those 6 rules well, I would like to advise the reader to visit the farmers market, where agricultural products are traded. In this market, we have many sellers and many buyers. Let us assume that we went to that market intending to buy 1 kg of apple.

As we know every product before it gets sold has a two price: buyer’s price and seller’s price (bid price, ask price).

Assuming that we are ready to pay 4 GEL per 1 kg of apple, so this is the bid price. This is the price that buyer is willing to pay. When we asked the seller for the price of 1 kg of apple, we got quotation of 5 GEL per 1 kg. So, this is the seller’s price (ask price).

Now, we have a situation, where we are ready to pay 4 GEL per 1 kg for the apple and the seller is willing to sell this product only for 5 GEL per kg. Consequently, no deal could be made, until one of the parties will agree on other’s condition. So, either seller agrees to sell us apple for 4 GEL per 1kg, or we agree on the seller’s condition and buy an apple for 5 GEL. Let’s review both the scenarios.

1) The seller agreed to sell us 1 kg apple for 4 GEL. It means that we have bought the product by limit order (bid price), and the seller sold us apples by market order (bid price as well). So, the deal was made on the market, where our buy limit order was matched with the seller’s market order, otherwise, no deal would be made.

So, when both parties agree to make a deal by bid price, the product price decreases. The seller wanted to sell his apples for 5 GEL per kg but had to agree on our conditions and sell it for 4 GEL.

Now imagine that after us, another buyer came to the seller and made to him the following offer. He is ready to pay for 1 kg of apple 3 GEL, but he wants to buy a 10 kg and not a 1 kg. So, the seller decided to agree on the buyer’s condition and sold him 1 kg of apple for 3 GEL. It means that now price on the apple went down and now cost of 1 kg of apple is 3 GEL.

2) We had to agree on the seller’s condition and bought 1 kg of apple for 5 GEL. It means that we have bought the product by market order (ask price), and the seller sold us apples by limit order (ask price). So, the deal was made, where seller’s limit order was matched with a buyer’s market order, otherwise there would be no deal.

So, when a deal between the parties is made by ask price, the product price goes up.

Now imagine, that the seller who sold us the product for 5 GEL per 1 kg has no apples in the stocks anymore and another seller next to him quotes 1 kg apples for 6 GEL. Next buyer after us, also agreed on seller’s offer and bought 1 kg apple for 6 GEL and now price of 1 kg of apple is 6 GEL, the price on apples has increased.

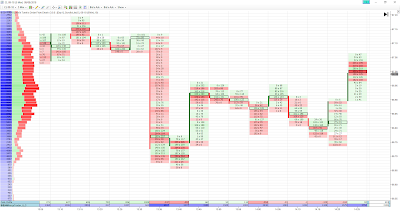

Now, based on all the above mentioned, let’s review the one particular trade that was made today on US crude oil futures, ticker – CL. This is a 5-minute cluster chart (footprint) of the given futures.

For a better understanding of this chart, I would like to add such terms as “bar volume”, “cumulative delta” and the “POC of the bar”.

Bar volume – this is the sum of all Ask and Bid volumes that are filled during the formation of this bar.

Cumulative Delta – this is the difference between Ask and Bid volumes during the entire period of the particular futures contract until his expiration. In other words, CD = Aggregate Ask Volume – Aggregate Bid Volume. Cumulative delta is calculated on every bar that is printed on the chart. If the cumulative delta is negative, it means that sellers prevail over the buyers at the market and if the cumulative delta is positive then we have a situation when buyers are dominant over the sellers.

POC of the bar – this is the maximum volume executed at the particular price level within the given bar.

It should be noted that only market orders are reflected on a footprint chart. On the left side we have all aggregate sell market orders filled at that particular price level within the bar and on the right side, we have all aggregate buy market orders filled at the same price level within the bar.

Pic.3 Cluster chart (footprint)

As we see from the picture at 13:35 price left the accumulation zone and moved down, consequently, all that players that hold buy positions and placed their stop-loss orders below $67 were dropped out from the market, because their stop-loss orders were activated by the price, and as we already know stop-loss orders of the buyers are nothing more but pending sell stop orders. So, as the result when the price reached $67 price level, buyers’ stop-losses were activated. Additionally, traders that adhere to price level break out strategies enters the market thus adding their sell orders, so we finally got the big size bar with big volume.

So, we get the price bar that decreased the price on 45 ticks. But the most interesting thing is that thought the bar is bearish, but if we look into his POC that maxim volume that was filled within that bar was a buyer’s volume. It means that an active buyer has shown himself at this price level.

Now, look at the bar volume and the cumulative delta data. We see the following information: volume: 6417, cumulative delta: - 347. If we compare this data with the same data of the previous bar, we would see the following: bar volume of the previous bar: 604, cumulative delta: 1028. As we see comparing to the previous bar, the volume on the current bar has increased by 10 times, and we also observe the significant increase in sell contracts.

After that, we need to see the developments in the next bar. We see the following data – bar volume: 3477, cumulative delta: - 432. Notwithstanding that bar volume decreased almost twice on the next bar, compared to other previous bars, it is still a big volume. But the most interesting thing is the following fact. Comparing to the previous bar the cumulative delta became more negative, which indicates that the number of sell market orders has increased on that bar.

It is logical that in this case, the close price of the current bar should be lower than the close bar of the previous bar and the current bar should also be bearish.

But we witness the opposite. Close price of the current bar is higher than the close price of the previous bar and what is more important the current bar is not a bearish, but bullish. We also see the POC of the bar is at $66.70 price level.

The following bar is an impulse bar and it is bullish. Bar volume: 4100, cumulative delta: 162, which indicates that a strong buyer entered the market.

So, based on all the above mentioned, we could make the following conclusion: big player used the situation that we had on the market in his favor, and when the retail traders were dropped off the market, as their stop-losses were activated and additionally other traders entered the market who work on the price level break out entered the market thus added their sell stop orders, the big players bought entire liquidity from them through their limit orders and after that started to move price up by their buy market orders. The price bar printed on 13:35 – 13:40 clearly indicates that.

Consequently, the right place to enter the buy position was from $ 66.77 price level, placing a stop-loss at $ 66.69.

Comments

Post a Comment